Kotak

Stockshaala

Chapter 4 | 2 min read

Calculating Home Loan Affordability: EMI, Interest Rate, and Tenure Impact

Buying a home is often the biggest financial commitment you’ll make, and determining how much you can afford requires careful planning. Three critical factors impact home loan affordability: EMI (Equated Monthly Instalment), the interest rate, and the loan tenure. In this chapter, we’ll explore how to calculate these factors using Excel so you can determine what works best for your financial situation.

What is EMI?

EMI (Equated Monthly Instalment) is the fixed monthly payment made toward repaying a home loan, consisting of both principal and interest. EMI helps spread the repayment over a specified period.

EMI Formula: EMI = (P × r × (1 + r)^n) / ((1 + r)^n - 1)

Where:

-

P = Loan amount (principal)

-

r = Monthly interest rate (annual rate / 12)

-

n = Loan tenure in months

Step-by-Step Guide: Calculating EMI in Excel

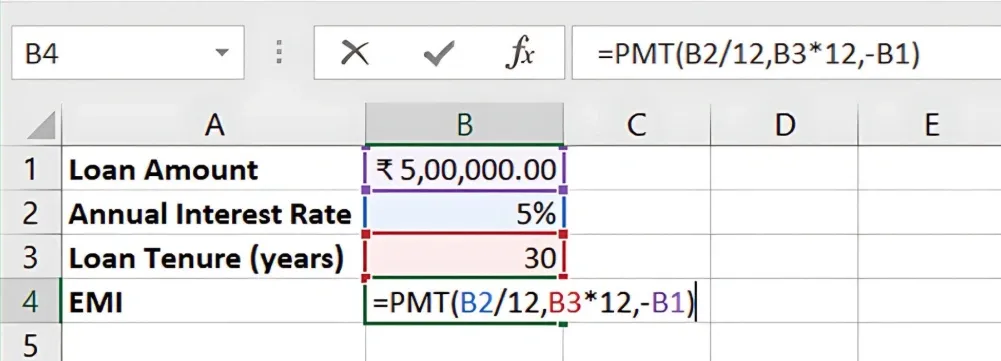

Step 1: Set Up the Loan Details

For example, let’s consider:

- Loan amount = ₹500,000

- Annual interest rate = 5%

- Loan tenure = 30 years

Step 2: Use Excel’s PMT Function to Calculate EMI

The PMT function in Excel calculates the EMI. The syntax is:

=PMT(rate, nper, pv)

For this example:

=PMT(5%/12, 30*12, -500000)

Result: The EMI for this loan is **₹2,684.11 **per month.

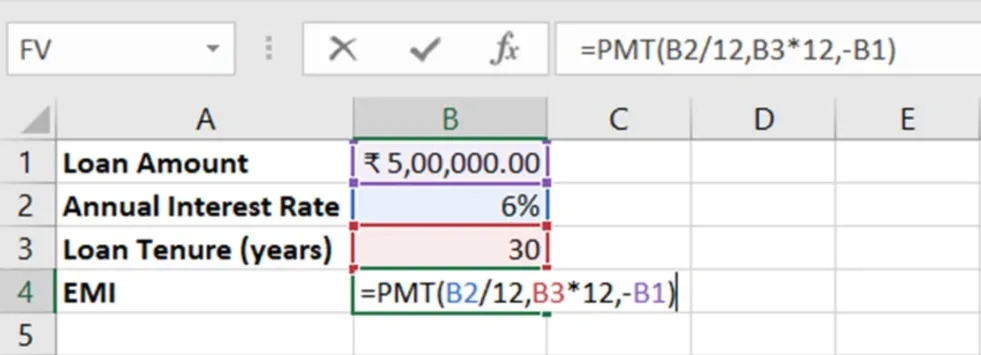

Step 3: Analysing the Impact of Interest Rate Changes

Interest rates can significantly affect EMI. Suppose the interest rate increases to 6%. Recalculate using:

=PMT(6%/12, 30*12, -500000)

Result: The EMI increases to ₹2,997.75 per month.

This demonstrates how even a small change in interest rates can impact monthly affordability.

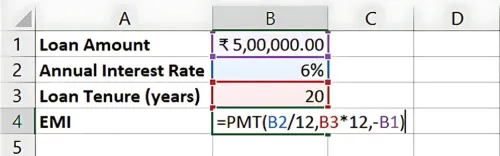

Step 4: Analysing the Impact of Loan Tenure

Loan tenure affects how long you’ll be paying the loan and how much total interest you’ll pay. If you reduce the tenure to 20 years:

=PMT(5%/12, 20*12, -500000)

Result: The EMI for a 20-year loan is ₹3,582.16 per month, but the total interest paid will be significantly lower compared to a 30-year tenure.

Creating a Loan Affordability Model in Excel

To make informed decisions, create a table to model different loan amounts, interest rates, and tenures. Here’s an example:

₹500,000 | 5% | 30 | ₹2,684.11 |

₹500,000 | 6% | 30 | ₹2,997.75 |

₹500,000 | 5% | 20 | ₹3,299.77 |

Key Takeaways:

-

EMI is determined by the loan amount, interest rate, and tenure.

-

A higher interest rate increases EMI, and a longer tenure lowers monthly payments but increases total interest.

-

Excel’s PMT function simplifies the calculation of EMI, helping you assess home loan affordability.

Conclusion:

Home loan affordability is determined by balancing the loan amount, interest rate, and tenure. Using Excel to model different scenarios helps you make informed decisions about how much home you can afford.

Next Chapter Preview: In the next chapter, we’ll explore Building a 3-Statement Financial Model in Excel (Income Statement, Balance Sheet, Cash Flow), focusing on how to create an integrated financial model to assess a company’s financial performance. Stay tuned for a comprehensive guide on financial modelling in Excel!

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.