Kotak

Stockshaala

Chapter 6 | 2 min read

Calculating the Capital Asset Pricing Model (CAPM) in Excel

The Capital Asset Pricing Model (CAPM) is a fundamental tool used to estimate the expected return on an investment based on its risk relative to the market. CAPM helps investors assess whether an asset is fairly valued, given its risk and the expected market return. Excel’s functions make it easy to calculate CAPM, providing valuable insights into risk-adjusted performance.

Why Use CAPM?

- Risk-Adjusted Return: CAPM estimates return based on an asset’s sensitivity to market risk.

- Investment Decisions: Helps determine if an asset provides adequate returns for its risk.

- Portfolio Optimisation: Useful for weighing asset allocation decisions based on expected returns.

CAPM Formula

The CAPM formula calculates the expected return on an asset:

Expected Return (CAPM) = Risk-Free Rate + β × (Market Return - Risk-Free Rate)

Where:

- Risk-Free Rate is the return on a risk-free asset (e.g., government bonds).

- Beta measures the asset’s sensitivity to market movements.

- Market Return is the expected return of the overall market.

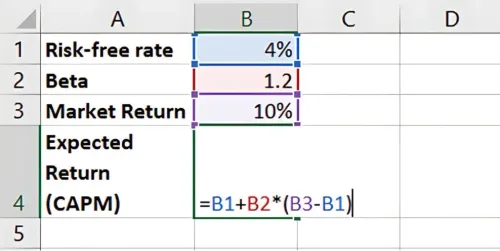

Step-by-Step Guide to Calculating CAPM in Excel

Step 1: Set Input Data

Assume you have the following parameters:

- Risk-Free Rate = 4%

- Beta of Stock = 1.2

- Market Return = 10%

Risk-Free Rate | 4% |

Beta | 1.2 |

Market Return | 10% |

Step 2: Apply the CAPM Formula in Excel

In Excel, input the CAPM formula:

= Risk-Free Rate + Beta * (Market Return - Risk-Free Rate)

For this example:

= 4% + 1.2 * (10% - 4%)

Result: The Expected Return (CAPM) is 11.2%. This is the return that compensates for both the time value of money and the investment’s risk.

Benefits of Using CAPM in Excel

- Quick Calculation: Excel’s functions allow for fast CAPM analysis.

- Scenario Analysis: Change inputs like Beta or Market Return to see different risk-adjusted returns.

- Investment Comparison: Compare the CAPM-derived expected returns of multiple assets.

Key Takeaways:

- CAPM calculates the expected return on an asset given its risk relative to the market.

- A higher beta results in a higher expected return due to increased sensitivity to market risk.

- Excel simplifies CAPM calculations, making it easy to incorporate into investment evaluations.

Conclusion

CAPM is an effective method for evaluating risk-adjusted returns, helping investors understand whether an investment aligns with their return expectations given its market risk. Using Excel, CAPM calculations are straightforward, enabling data-driven investment decisions.

Next Chapter Preview: In the next chapter, we’ll cover Weighted Average Cost of Capital (WACC) Calculation. WACC helps determine a company’s cost of capital, combining equity and debt costs, which is crucial for evaluating investments and financial decisions. Stay tuned!

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.