Kotak

Stockshaala

Chapter 1 | 3 min read

Understanding Futures Contracts - Basic

As Rajesh continued his journey into derivatives, he decided to learn more about futures contracts, the tool he had been using to protect his wheat crop. Rajesh had already secured fair prices for his wheat using futures, but now he wanted to understand the mechanics of these contracts and why they are so effective.

For instance, suppose Rajesh enters into a wheat futures contract to sell 100 tons of wheat at ₹2,000 per ton, with the contract expiring in three months. By locking in this price, Rajesh is shielded from any decline in wheat prices during this period. If, at expiration, the market price drops to ₹1,800 per ton, Rajesh will still sell at the agreed price of ₹2,000, avoiding a potential loss.

What Is a Futures Contract?

A futures contract is an agreement to buy or sell an asset at a specified price on a future date. Unlike forward contracts, which are private agreements, futures are:

- Standardised: Terms are set by the exchange.

- Exchange-Traded: Ensuring transparency, liquidity, and reduced counterparty risk.

These features make futures more reliable and accessible than forwards.

Key Features of Standardised Futures Contracts

Expiration Date | The date when the contract expires and must be settled. |

Lot Size | The fixed quantity of the underlying asset covered by one futures contract. |

Underlying Asset | The asset on which the futures contract is based (e.g., commodities, financial instruments). |

Margin Requirement | The minimum amount required to open and maintain a position, including initial and maintenance margins. |

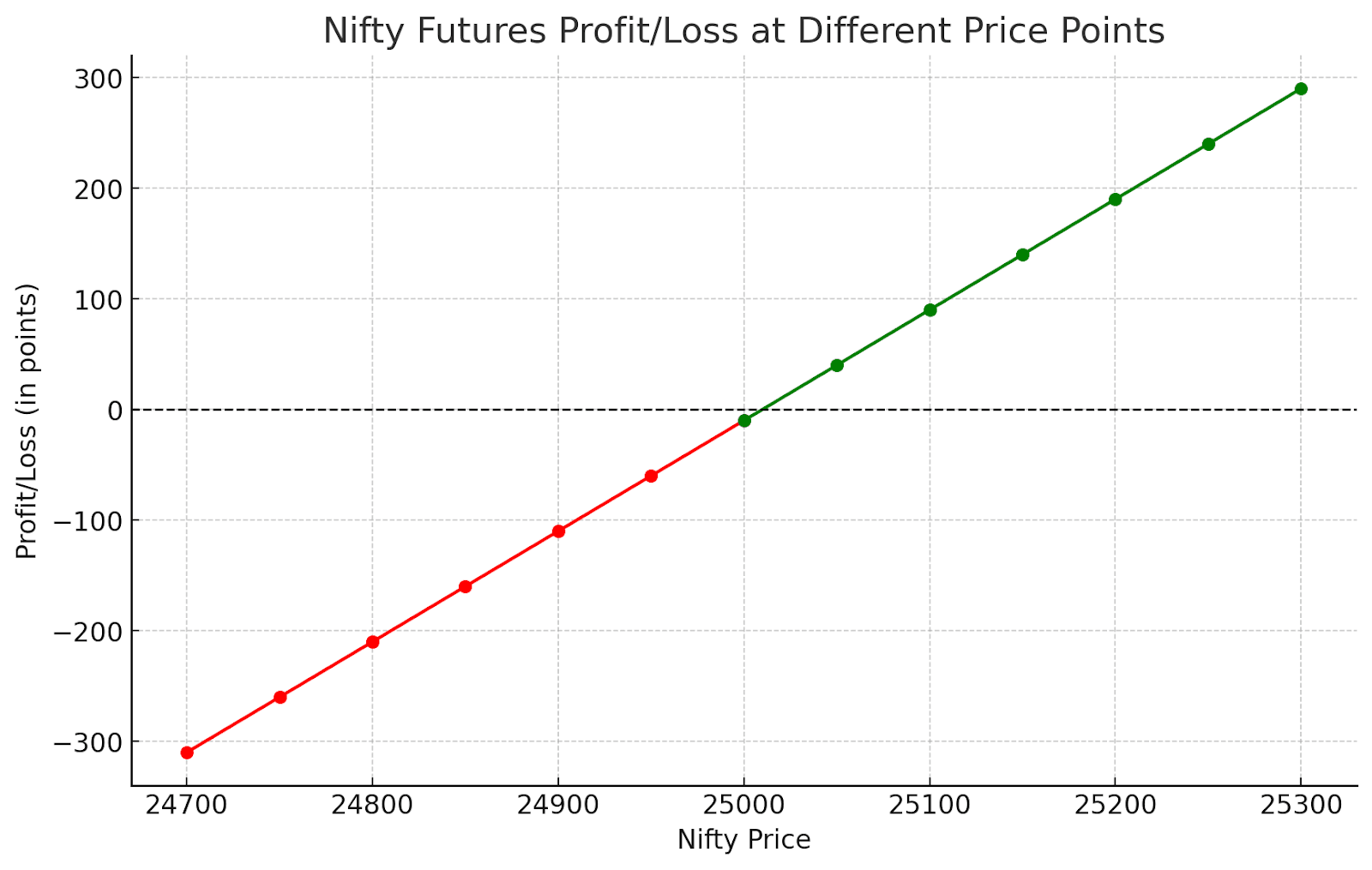

Mark-to-Market | Daily profit or loss adjustments based on market price changes, settled in the margin account. |

Settlement Type | Indicates whether the contract is cash-settled or requires physical delivery of the underlying asset. |

Contract Month | The month in which the contract expires, identified by a specific code. |

Contract Value | The total value of the contract, calculated as the lot size multiplied by the underlying asset's current price. |

Tick Size | The minimum price movement allowed for the contract, defining the smallest price increment. |

Position Limits | The maximum number of contracts a trader can hold for a specific asset. |

Trading Hours | The hours during which the futures contract can be traded on the exchange. |

Why Futures Are Popular

Rajesh discovered that hedging was the main reason he used futures contracts. By locking in a price for his wheat, he effectively reduced his exposure to market fluctuations. However, he also learned that many other participants, including investors and companies, use futures to manage risks across a range of assets such as:

- Commodities: Gold, silver, crude oil.

- Financial Instruments: Indices, stocks, and currencies.

The Role of Exchanges

In India, futures contracts are actively traded on exchanges like:

- National Stock Exchange (NSE)

- Bombay Stock Exchange (BSE)

- Multi Commodity Exchange (MCX)

- National Commodity and Derivatives Exchange (NCDEX)

The standardisation of contracts by these exchanges ensures:

- Liquidity: Contracts are easy to trade.

- Transparency: Prices are visible to all participants.

- Reliability: Standard terms reduce counterparty risk.

For example, the exchange determines the contract size, quality standards, and delivery terms, making futures more accessible than forwards.

Conclusion

Futures contracts allow participants like Rajesh to hedge against unpredictable price movements while offering standardised and liquid trading opportunities. They are invaluable tools for managing price risk, not only for farmers but also for traders and businesses dealing with volatile markets.

In the next part, we’ll explore additional features such as liquidity, mark-to-market adjustments, and margins. We’ll also discuss the types of participants in the futures market and strategies like hedging, speculation, and arbitrage.

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.