Kotak

Stockshaala

Chapter 2 | 3 min read

Understanding Futures Contracts - Advanced

In the first part of this chapter, we explored the basics of futures contracts, covering standardisation, expiration dates, and lot sizes. Rajesh used futures contracts to hedge his wheat crop, showcasing how these instruments help manage risk. Now, we’ll delve deeper into advanced features, including liquidity, mark-to-market, and margins. Additionally, we’ll look at different participants in the futures market and strategies like hedging, speculation, and arbitrage.

Liquidity: A Key Advantage

One major advantage of futures contracts is their liquidity. Unlike forward contracts, which require both parties to hold until expiration, futures can be bought or sold at any time before their expiry. Exchanges ensure there’s always a market for these contracts, allowing participants to enter or exit positions with ease. This flexibility makes futures especially appealing for traders looking to adjust their exposure dynamically.

Mark-to-Market: Daily Adjustments

Futures contracts are marked-to-market daily, meaning gains and losses are settled at the end of each trading day. For example, if the price of wheat rises, Rajesh’s futures contract is adjusted, and his profit is credited to his account. Conversely, if prices fall, he must pay the difference. This daily settlement ensures participants react to market changes in real-time, reducing the risk of significant losses at expiration.

Margins and Leverage

In futures trading, you don’t pay the full value of the contract upfront. Instead, you deposit a margin, which acts as collateral to ensure obligations are met. Margins allow you to control a larger position with less money, providing leverage.

- Benefit: Leverage amplifies potential profits.

- Risk: It also magnifies losses if the market moves against you.

Settlement Types

Most futures contracts in India are cash-settled, meaning there’s no physical delivery of the asset. At expiration, the difference between the agreed-upon price and the market price is settled in cash. This makes futures more convenient for traders focused on price movements rather than physical assets.

Strategies in Futures Trading

Futures contracts are versatile and can be used for various purposes:

- Hedging: Protect yourself from price fluctuations. For example, Rajesh hedged against falling wheat prices.

- Speculation: Bet on price movements to profit without owning the asset.

- Arbitrage: Take advantage of price discrepancies between markets by buying in one and selling in another.

Participants in the Futures Market

The futures market attracts a variety of participants:

- Retail Traders: Often speculate or arbitrage.

- High-Net-Worth Individuals (HNIs): Hedge or speculate to manage risk or profit from price changes.

- Institutions: Banks and funds primarily hedge large exposures to minimise risks.

Lot Sizes of Common Futures Contracts

Here’s an overview of lot sizes for some popular futures contracts in India:

Nifty Index | 75 units |

Sensex | 15 units |

Reliance Industries | 505 units |

Gold | 1 kg |

Crude Oil | 100 barrels |

Example: Nifty Futures

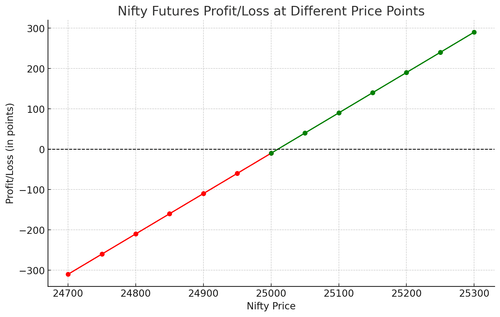

Suppose Nifty is trading at 25,000, and you buy a futures contract at 25,010. The table below shows potential profits or losses as the price moves in intervals of 50 points:

The chart illustrates how your profit or loss would vary based on the movement of Nifty. If the price rises above 25,010, you profit. If it falls below, you incur a loss. This example highlights how futures allow you to speculate on price movements effectively.

Conclusion

Futures contracts are powerful tools for managing risk, providing liquidity, and enabling hedging, speculation, and arbitrage. Their standardisation and exchange-traded nature make them accessible and reliable. Rajesh now understands the importance of features like mark-to-market and margins in futures trading.

In the next chapter, we’ll explore options, another derivative that offers even greater flexibility, allowing traders to hedge risks and seize market opportunities.

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.