Kotak

Stockshaala

Chapter 3 | 3 min read

Calendar Spread Strategy

During our last talk on the Iron Butterfly Strategy, we went through a step-by-step approach on how one can profit in range-bound markets, targeting a price point with limited risk. Today, we move to the Calendar Spread Strategy-a time-tested method that will leverage time decay and volatility differences for traders expecting markets that are either stable or showing a mild trend. Now, let's get deep into the details.

What is a Calendar Spread Strategy?

The Calendar Spread, also called a time spread, is an advanced option trading strategy in which:

- You buy a longer-term option (farther expiry).

- You sell a shorter-term option (nearer expiry).

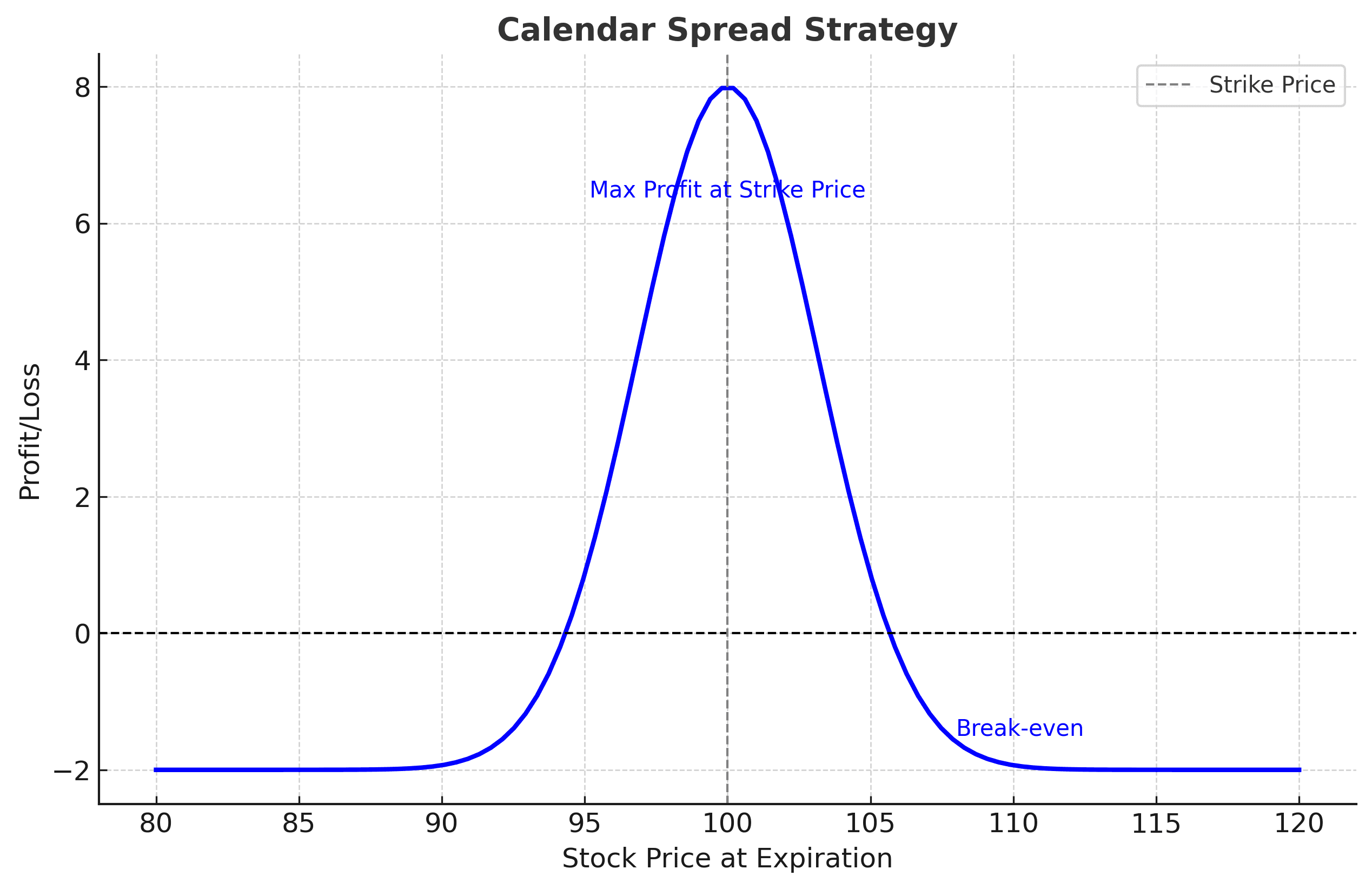

Both the calls have the same strike price but a different expiration date. The strategy is thriving on time decay 'Theta' and benefits when volatility increases. It aims to profit when the underlying asset like Nifty or Bank Nifty, remains near the strike price of the options because the shorter-term option loses value faster.

Why Traders Choose It

The Indian stock market is perfectly suited for Calendar Spreads due to its frequent expirations and event-driven volatility. Here's why traders favor this strategy:

1. Limited Risk: The maximum loss is fixed at the net debit paid to set up the trade.

2. Volatility Play: This would involve profits made on the increase in implied volatility, generally before events such as earnings or RBI announcements.

3. Adaptability: Works well in neutral markets but can be tailored for slightly bullish or bearish trends.

When to use the Calendar Spread?

The Calendar Spread works best in the following situations:

1. Low Volatility Periods: The strategy should be initiated when the volatility is low and is expected to increase.

2. Pre-Event Setup: Use it ahead of major events, including monetary policy decisions or earnings releases.

3. Neutral or Mild Trends: This is an ideal scenario when you expect the underlying asset to hover around a particular price level.

How to Set It Up: An Example

Assume Nifty is trading at 19,600 and you expect it to keep this level for the coming week. Here's how to construct a Calendar Spread:

- Buy a longer-term Nifty 19,600 Call (e.g., expiry in two weeks).

- Sell a shorter-term Nifty 19,600 Call (e.g., expiry this week).

This setup works because:

- The shorter-term option decays faster, allowing you to retain more of the premium received.

- This means that an increase in implied volatility helps the longer-term option increase in price.

Key Benefits

1. Time Decay Advantage: profit from the quicker decay of this shorter-term option.

2. Volatility Boost: The increased implied volatility helps the longer-term option considerably more.

3. Low-capital requirement: It means low risk strategy that functions well even for accounts which are of smaller amounts.

Risks to Watch

While Calendar Spreads are relatively low-risk, sharp price movements away from the strike price can reduce profitability. Additionally, a drop in implied volatility can negatively impact the longer term option's value.

Conclusion

The Calendar Spread Strategy would be a great way for any trader to get maximum benefits from time decay and volatility dynamics. Be it Nifty, Bank Nifty, or individual stocks, this is a flexible and controlled risk approach for stable markets. If the Calendar Spread Strategy fascinated you, our next topic of discussion, the Vertical Spread Strategy which introduces you to a simple, yet versatile approach to trading. Ideal for directional market views, it is an essential strategy for controlling risk while targeting consistent returns.

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.