Kotak

Stockshaala

Chapter 2 | 3 min read

Iron Butterfly Strategy

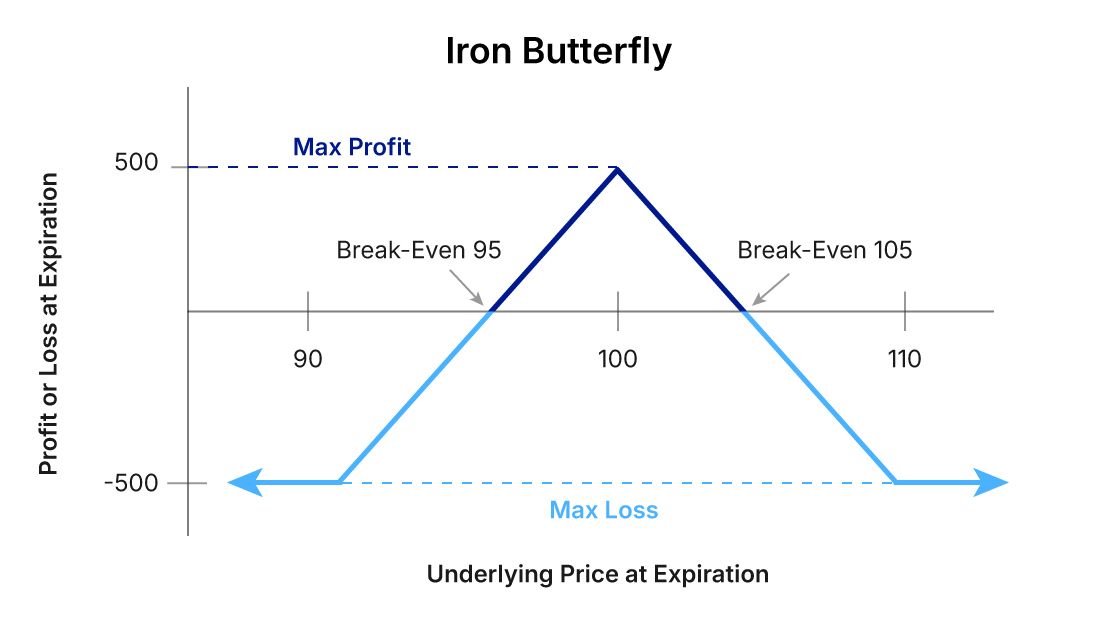

In the previous lecture, we discussed the Iron Condor Strategy as a pretty sure shot ranges-bound market strategy that presented limited risks and sure-shot returns. Today, we will look at its close cousin the Iron Butterfly Strategy, which involves a more focussed way of trading in options as one expects the market to dance around a particular price point.

What is an Iron Butterfly Strategy?

The Iron Butterfly is an advanced options strategy that was designed to profit from a range-bound market with a tight range of price expectation. Similar to the Iron Condor, the key difference is that in an Iron Butterfly, options all center around one strike, this makes it an aggressively positioned trade.

Here's how it's set up:

1. Sell one at the money call option.

2. Buy one out of the money call option.

3. Sell one ATM put option.

4. Buy one OTM Put.

The result is a strategy that shows maximum profit at the strike prices of the options sold and contains limited risk, like the Iron Condor, though it carries a narrower range of profitability.

Why Traders Choose It

The Iron Butterfly Strategy works beautifully in low volatility markets, which is not an unheard of scenario in the Indian stock market. For example, the Nifty and Bank Nifty tend to consolidate in a range around specific levels during quiet periods such as earnings seasons or preceding major policy decisions.

Some of the key reasons why Indian traders prefer this strategy include:

1. Focused Profits: With the Iron Butterfly, the potential profits are larger than for the Iron Condor since the range is tighter.

2. Limited Risk: The loss is limited by the bought protective options.

3. Lower Capital Requirements: The strategy, due to its defined risk, is subject to lower margins and thus is more accessible for retail traders.

When to Use the Iron Butterfly?

Timing is everything in the Iron Butterfly Strategy. Here's when it works exceptionally well in the Indian market:

-

Low Volatility Periods: The strategy works very well in periods when India VIX is low, reflecting that the market is showing minimal movement.

-

Technical Levels: It is suitable to use when the technical analysis foretells that the underlying asset will always hang around a certain level.

-

Anticipation of Event: Before any earnings or RBI announcements, markets often settle near key levels, this is one perfect strategy that will find its place in such market scenarios.

How to Set Up: An Example

Let's consider the following example: Nifty is trading at 19,600, and you expect it to keep hovering around this mark for the next two weeks.

1. Sell one ATM Call at 19,600.

2. Buy one OTM Call at 19,800.

3. Sell one ATM Put at 19,600.

4. Buy one OTM Put at 19,400.

Here's how it works:

Maximum Profit: The profit is achieved when the Nifty closes at 19,600. The profit will be the premium collected from the sale of options minus the cost of buying the protective options.

Maximum Loss: Limited to the difference between the strike prices of the call or put legs minus the net premium received.

Risks to be Aware

While the Iron Butterfly is a limited risk strategy, the small range means that sharp price movements outside the defined range could result in a loss. Thus, accurate market analysis is required when this strategy is deployed.

Conclusion

The Iron Butterfly Strategy is indeed for a trader to reap benefits when the markets are likely to hover around a particular price. It gives higher returns compared to the Iron Condor but requires greater precision in predicting the market movements.

If the Iron Butterfly Strategy fascinated you, then our next topic, the Calendar Spread Strategy is going to take your options trading to the next level. It is a strong strategy to capitalize on time decay and volatility differences between expiries, hence ideal for traders looking for consistent returns in the Indian market.

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.