Kotak

Stockshaala

Chapter | 3 min read

Collar Strategy

In the previous chapter on Diagonal Spread Strategy, we learned a really versatile options trading strategy that combines directional views with time and volatility dynamics. Today, we change focus to the Collar Strategy, a conservative yet highly effective hedging strategy to lock in profits. This strategy would work well for any trader or investor or trader in India, especially for those who seek protection of capital in such volatile markets. Let's break it down.

What is a Collar Strategy?

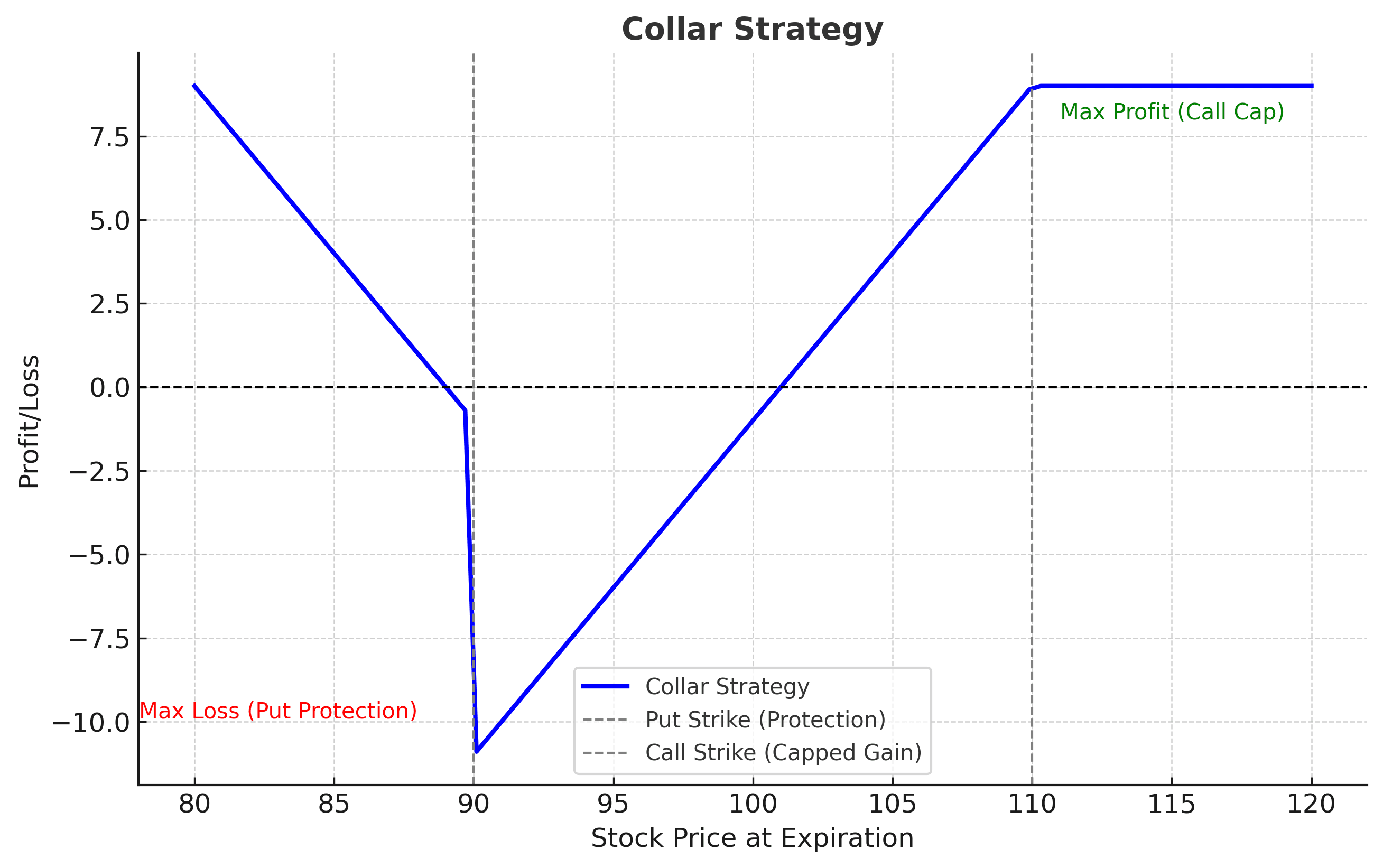

The Collar Strategy is an option hedging strategy that combines:

- Owning a stock or holding a long position in an underlying asset.

- Buying a protective put option (insurance against downside risk).

- Selling a call option (to offset the cost of the put).

This creates a "collar" around your position by capping both potential losses and gains. It is widely used by traders and investors who want to lock in profits or minimize risk during uncertain market conditions.

Why Traders Love It

The Collar Strategy is, in fact, one of the best ways to hedge your portfolio against events that might make the Indian market volatile. These events may include announcements of the RBI, election results, or corporate earnings announcements. Here's why it is a favorite:

-

Capital Protection: The strategy does not require one to leave the stock or the position to limit downside risk.

-

Cost-Effective: The premium received from the sale of the call defrays the cost of buying the protective put.

-

Ideal for Events: Perfect to hedge event risk ahead of big market-moving events.

When to use the Collar Strategy?

The Collar Strategy works best when:

-

You Have Unrealized Gains: You can protect profits in an unsold stock or a current position.

-

Market Uncertainty: Hedge against potential volatility before key events or announcements.

-

Moderate Bullish Outlook: It is applied when one remains optimistic with moderate gains yet still wants protection against sudden, unexpected drops.

How to Set It Up - An Example

Stock Example

Suppose you have 100 Reliance shares and the market price of the stock is ₹2,500. You think this could be a potential downside risk, yet you would not want to sell your shares.

- Buy a ₹2,400 Put: This protects you if Reliance falls below ₹2,400.

- Sell a ₹2,600 Call: This caps your upside profit if Reliance rises above ₹2,600.

How It Works

- Maximum Loss: Limited to ₹ 100 per share (₹ 2,500 - ₹ 2,400) minus the net premium received.

- Maximum Profit: Capped at ₹100 per share (₹2,600 - ₹2,500) minus the net premium paid.

Key Benefits

-

Risk Mitigation: It saves your portfolio from huge losses.

-

Cost Efficiency: By selling the call, that offsets part or all of the cost of the put.

-

Flexibility: You can vary the strike prices according to your risk appetite and your view on the market.

Risks to Watch

While the Collar Strategy does limit losses, it also caps potential profits. In the event of a sharp upside move in the market, the sold call may get exercised, and you will have to sell your stock at the strike price, thus missing out on further upside.

Conclusion

The Collar Strategy is a great strategy that can help the trader or investor hedge his portfolio from unexpected movements in the market. Your returns can be locked in along with risk management and stay in the game even when markets turn unpredictable. If you enjoy learning about risk-managed strategies, then our next chapter is for you, as we delve deeper into an advanced strategy known as the Ratio Spread Strategy, in which market participants can profit with directional markets yet be balanced in terms of risk.

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.