Treasury Bills (T-Bills)

T-Bills are short-term debt instruments issued by the Government of India to manage short-term liquidity. They are zero-coupon securities, meaning they don’t pay interest — instead, they’re issued at a discount and redeemed at face value.

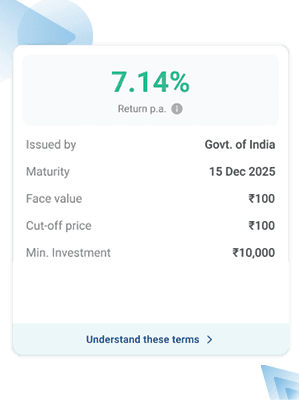

Key Highlights

Park funds smartly. Get returns without waiting long.

Secured by Government

A trusted and regulated investment backed by the central government.

Tenures of 91, 182, and 364 Days

Choose the duration that fits your short-term goals.

Sell Anytime on Exchange

Buy and sell T-bills on the exchange during market hours.

Zero-Coupon

Buy at a discount. Redeem at full value

How Do T-bills Work?

Buy at a discount. Get full face value on maturity. No interest, just built-in returns.

Let’s Learn How T-Bills Work with an Example

Step 1. A T-Bill is Announced:

The RBI announces a 91-day T-Bill with a cut-off price and face value of ₹100.

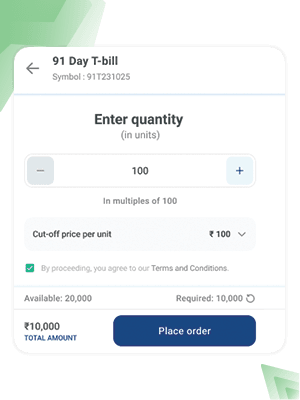

Step 2. You Place an Order:

You apply for 100 units at ₹100 each.

Amount Blocked: ₹10,000

- This is the maximum you’ll pay; the actual price could be lower.

Step 3. Auction & Allotment:

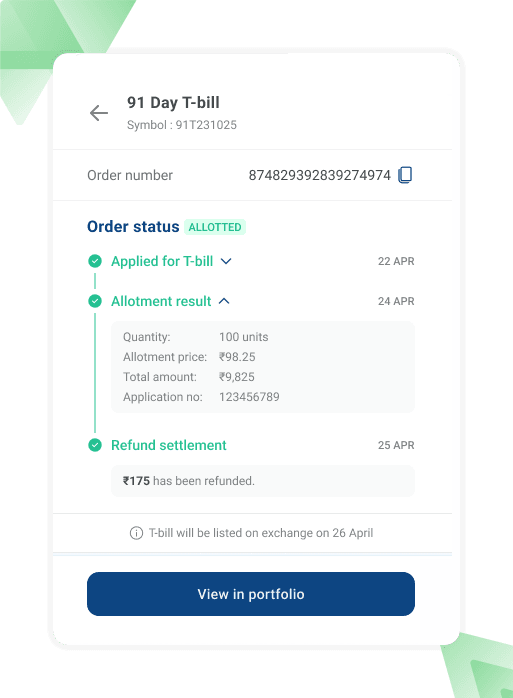

What Happens After You Bid?

- Once bidding ends, a final price is decided (e.g., 96.25).

- You’re allotted 100 units at this final price.

- Since you had paid ₹10,000 in advance and only ₹9825 is needed, ₹175 is refunded to your bank account.

- The allotted units are credited to your demat account automatically.

Step 4. What Happens at Maturity:

- On maturity (after 91, 182, or 364 days), the full face value (₹100 per unit), i.e ₹100 is credited to your bank account.

- Net Investment: ₹9825

- Principal Returned: ₹10,000

- Net Earnings: ₹175

Exiting Before Maturity

You don’t need to hold T-bills until maturity.

- Sell anytime on the exchange via your demat account

- Sale value will depend on market demand and prevailing interest rates

- You may receive more (premium) or less (discount) than what you paid

Tip: While early exit is allowed, T-bills prices can fluctuate, and liquidity may vary—so plan your holding period accordingly

Frequently Asked Questions

Open Demat Account

Open Demat Account