State Development Loans (SDLs)

SDLs are government bonds issued by individual states in India to raise money for development projects like roads, health, or education. Like central government bonds (G-Secs), SDLs are low-risk, fixed-return instruments — but with slightly higher yields in some cases.

Let's Learn How Do SDLs Work with an Example.

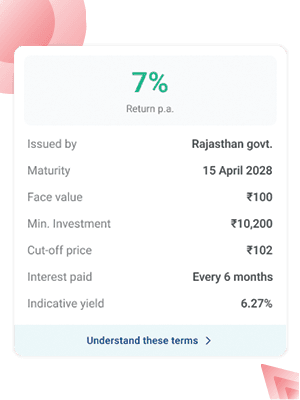

Step 1. An SDL is Announced:

The RBI announces a State Development Loan – Karnataka SDL 2027 (tenure of 3 years) with a coupon rate of 7% and a cut-off price of ₹102.

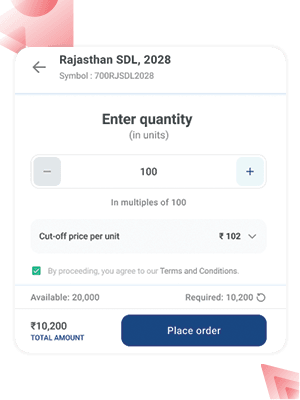

Step 2. You Place an Order:

You choose to invest — e.g., 100 units at cut-off price

- ₹10,200 (₹102 x 100) is blocked.

- This is the maximum you’ll pay; the actual price could be lower.

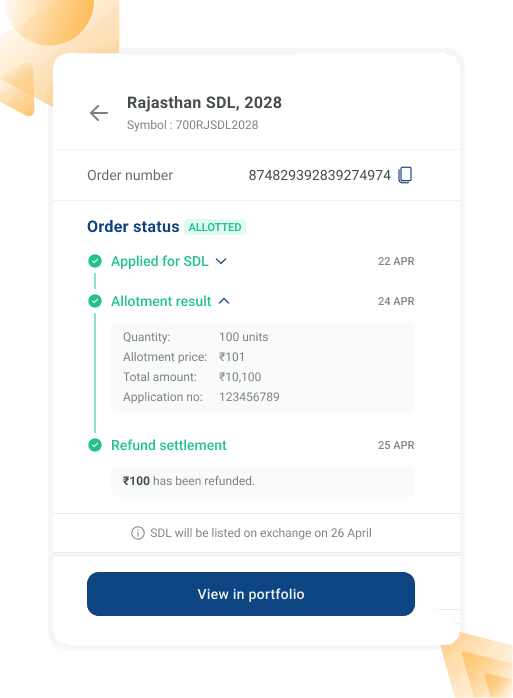

Step 3. Auction & Allotment:

What Happens After You Bid?

- Once bidding ends, a final price is decided (e.g., ₹101).

- You’re allotted 100 units at this final price.

- Since you had paid ₹10,200 in advance and only ₹10,100 is needed, ₹100 is refunded to your bank account.

- The allotted units are credited to your demat account automatically.

Step 4. What happens after allotment:

You Start Receiving Interest.

SDLs pay fixed interest twice a year. You earn on the face value (usually ₹100), not on your purchase price.

- Coupon Rate: 7% annually → 3.5% semi-annually

- Face Value : ₹100

- Tenure: 3 years (6 interest payouts)

0 – 6 Months | 3.50% | ₹350 |

6 – 12 Months | 3.50% | ₹350 |

1 – 1.5 Years | 3.50% | ₹350 |

1.5 – 2 Years | 3.50% | ₹350 |

2 – 2.5 Years | 3.50% | ₹350 |

2.5 – 3 Years | 3.50% | ₹350 |

Total Interest earning ₹2,100

The interest is credited to your bank account automatically every 6 months.

Step 5: What Happens at Maturity? (End of Year 3):

a. Principal Repaid:

You receive ₹10,000 (₹100 × 100 units), as bonds are redeemed at face value, not at your purchase price of ₹101.

b. Final Interest Credit:

The last ₹350 interest (if not already paid) is deposited into your bank account.

c. Your Total Returns:

- Total Invested: ₹10,100

- Interest Earned: ₹2,100

- Principal Returned: ₹10,000

- Net Earnings: ₹2,000

You don’t need to hold SDLs until maturity.

- Sell anytime on the exchange via your demat account

- Sale value will depend on market demand and prevailing interest rates

- You may receive more (premium) or less (discount) than what you paid

Tip: While early exit is allowed, SDLs prices can fluctuate, and liquidity may vary—so plan your holding period accordingly