Kotak

Stockshaala

Chapter 2 | 3 min read

Open Interest & Volumes

In our previous blog, we explored Risk Measurement Tools. Understanding those tools places you more in the know for market uncertainties and makes a well-calculated decision. Now we will discuss how Open Interest and Volumes might provide some critical clues on market trends that augment your trading strategy further.

So, you are trading in India or specifically in futures and options derivatives. You've probably come across terms like "Open Interest" and "Volumes." On the face of it, they sound too technical and complex. Understandably, that's not enough to give the right insight or make any informed decisions when trading in the market.

What is Open Interest?

Open Interest (OI) is the number of outstanding contracts that remain open and unsettled, including futures or options. More simply, it is the count of active trades that remain open. For instance, when you buy a futures contract and someone else sells, then OI increases. When you sell the contract afterwards, OI decreases.

OI is very significant for derivative markets. An increasing OI suggests new positions are being opened. It indicates a strong trend. However, a falling OI means that traders are closing positions. Hence, the trend is losing momentum.

What Are Volumes?

Volumes are the number of contracts or shares that have been traded within a given period, usually a day. Higher volumes mean higher activity and liquidity in the market, making it easier to get in and out of the trade. In the market, volumes play a key role in price discovery. Less price volatility is experienced in a stock with high volumes; hence, it is more reliable to trade.

The Relationship Between Open Interest & Volumes

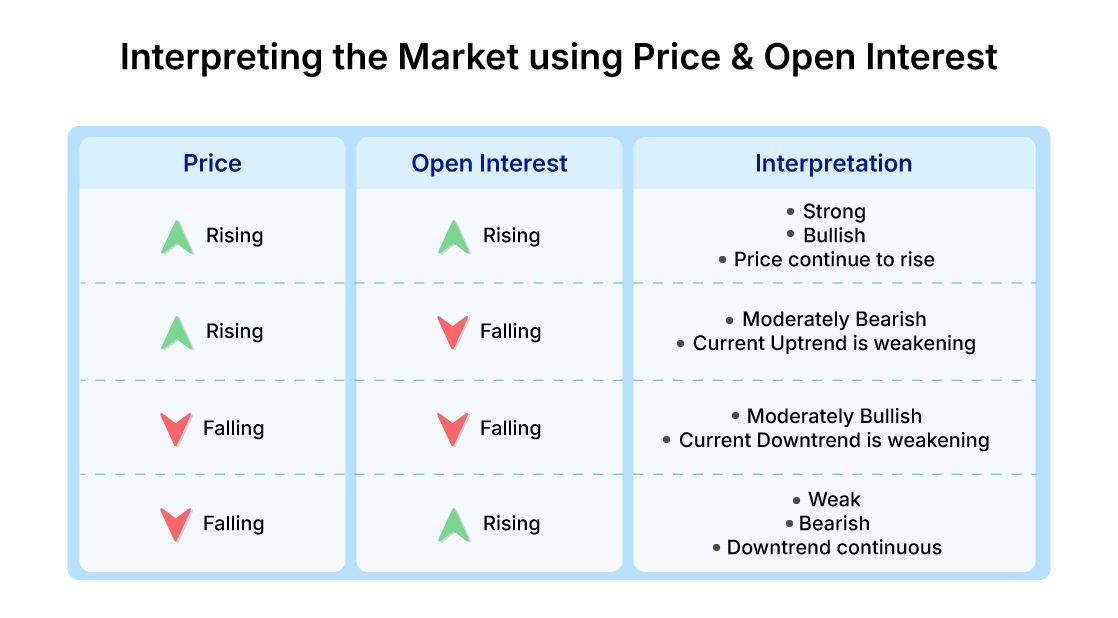

To understand the market trend, traders tend to analyse OI and volumes together. Here's how these two metrics relate:

- Increasing OI with increasing volume: This is a bullish or bearish signal, depending on the direction of the trend. If OI and volume are both rising, it indicates that new participants are entering the market, suggesting the current trend will likely continue. In futures and options markets, this is often seen when institutional investors or large traders become active.

- Increasing OI but volumes are decreasing: A bearish sign where an increasing number of positions (OI) is opening with less volume; it describes that though new positions are entering in (OI is increasing), falling volume indicates a lack of conviction, and the trend may not hold any more.

- Decreasing OI with increasing volume: An aggressive closing of positions. Often visible during corrections when a trade is losing its momentum.

- Decreasing OI with decreasing volume: This is usually a sign of market consolidation. It shows little new activity, which could be a pause before the next big move.

Open Interest & Volumes Key Detail

The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) give out detailed data on OI and volumes for both equity and derivatives markets. For retail traders, this would be a critical insight to monitor during key market events like the Union Budget or RBI policy announcements, when OI and volumes tend to spike.

Conclusion

Open Interest and Volumes are two essential tools for traders in dynamic markets. You will understand market sentiment better, spot trends, and anticipate possible reversals by keeping an eye on both metrics. Whether you trade in Nifty futures, Bank Nifty options, or individual stocks, these indicators can add immense value to your trading strategy. So, the next time you look at a market, remember to look at the OI as well as the volumes; they may just bring you clarity.

In our next blog, we'll take an in-depth look at Implied Volatility, an options trading metric that shows market expectations for future price movement. It's useful to know your implied volatility because this metric can help you better gauge market sentiment and value your options relative to each other.

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.