Kotak

Stockshaala

Chapter 1 | 3 min read

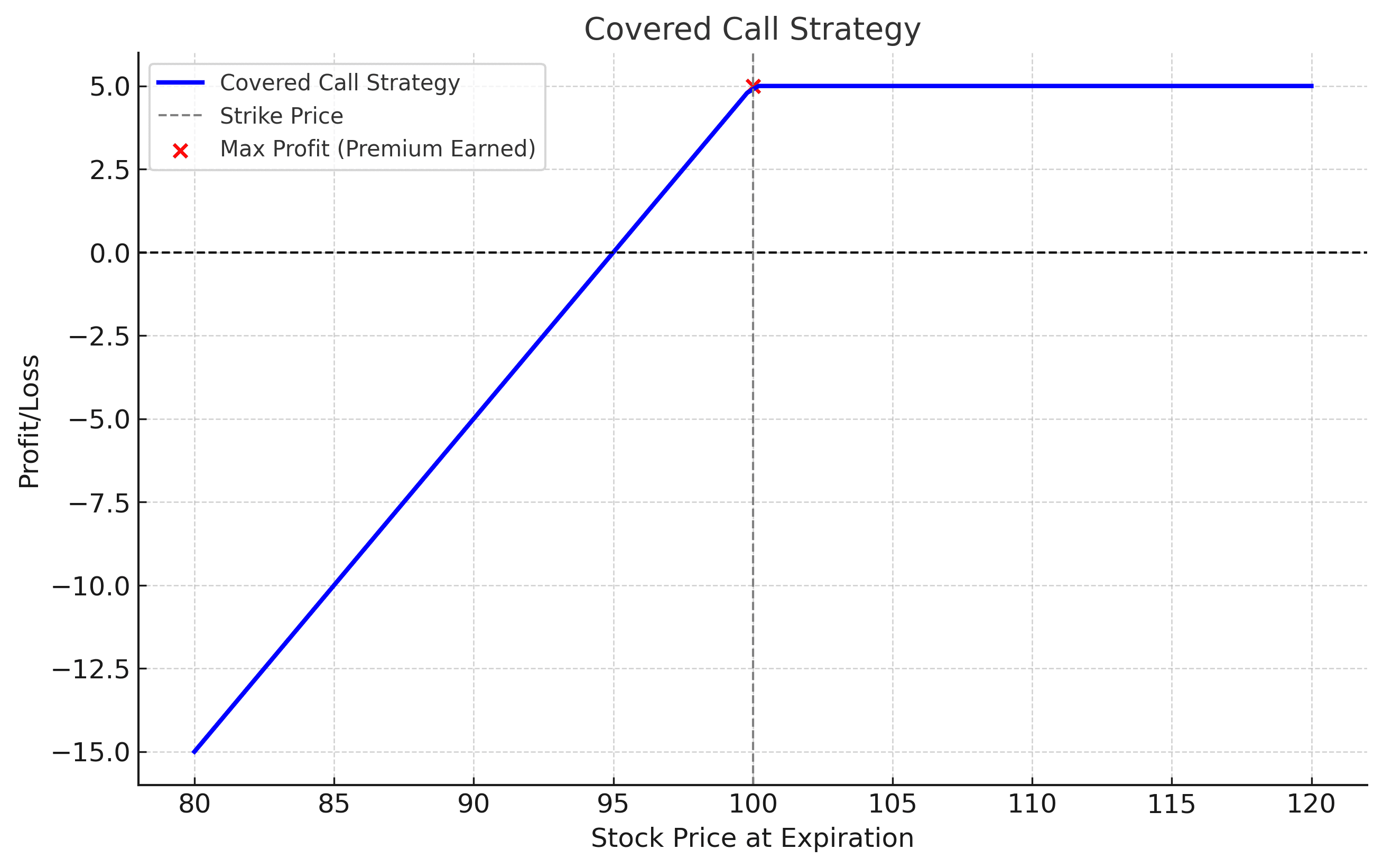

Covered Call Strategy

Now that you have a fair idea of Call and Put options, let us look into one of the most practical strategies that many investors use to come up with extra income, it's called the Covered Call. An approach like this can avail premium income from stocks that are already in your portfolio but require their own set of risks versus rewards. Let's understand how it works and how you are able to apply it to your portfolio.

What's a Covered Call?

A covered call is an options strategy whereby an investor sells a call option on a stock they own. In selling the call option, you give the buyer a right, but not obligation, to buy your stock at a pre-set price, known as the strike price, prior to expiration of the option. You will sell this call option at a premium, the price a buyer pays for the option.

For example:

- You have 100 shares of Reliance Industries valued at ₹2,000 each.

- You sell a call option. The strike price is ₹2,200, the expiry will be in one month and you get a premium against that of ₹50 per share.

- However, in case the Reliance remains below ₹2,200, the option will expire worthless, and one can have both the stock with him and also retain ₹50 premium.

- If the price of the stock rises above ₹2,200, the buyer will exercise his option and buy your shares at ₹2,200. You still get to keep the ₹50 premium but your shares are sold at ₹2,200.

Either way, you receive additional income from the premium whether the option is exercised or not.

Why use the covered call strategy?

The main application of the Covered Call strategy is generating extra income from stocks you already own. The following is the reason behind its popularity:

1. Extra Income: The premium that one collects by selling the call option provides extra income, a sweet bonus when one owns shares of slow growth and steady stocks.

2. Downside Protection: The premium acts as a cushion in case the stock price falls. Suppose your stock fell by ₹50, that could be offset by the premium.

3. Suitable for Stable Stocks: Covered calls are ideal for well-established companies like HDFC Bank, Infosys, or TCS, whose prices don't fluctuate drastically. These stocks are often ideal for generating income through covered calls.

Risks of the Covered Call Strategy

With its potential rewards, the covered call strategy also carries some risks:

1. Limited Upside: If the stock price shoots up way above the strike price, your profit is limited to a strike price plus premium. That is, if Reliance goes up to ₹2,500, you will be selling at ₹2,200 and thus will not take the benefit of the additional gain.

2. Stock Ownership Risk: You still bear the risk of owning the stock. If the stock price falls significantly, possibly the premium you received will not be adequate to overcome that loss.

3. Requires Stock Ownership: You can only implement a covered call if you own the stock, limiting its flexibility compared to other strategies.

When to apply the covered call strategy?

The covered call strategy works best when:

You are neutral to slightly bullish: You feel the stock will either stay flat or rise modestly; this strategy will provide steady income.

The market is sideways: This approach can provide perceiving premiums within a very slow market.

You're a long-term investor: If you are holding stocks for steady growth, the covered call strategy allows income to be generated without liquidating any shares.

Conclusion

The covered call strategy is an excellent method to generate extra income in your stock portfolio. It will be most effective in markets that are flat or see a minor movement. While it cuts off the upside potential, it returns with additional income from premiums and a cushion for minor declines.

Now that you have viewed the Covered Call Strategy. In the next chapter let's take a look at another very popular strategy meant to help you protect your investments, the Protective Put. This strategy involves the buying of a put option to protect your stock against huge downside risk. Let's dive into how this strategy works and how it can act as a safety net in volatile markets.

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.