Kotak

Stockshaala

Chapter 1 | 3 min read

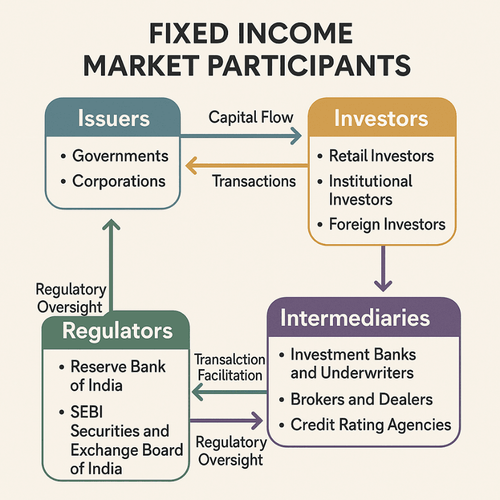

Fixed Income Market Participants

The fixed income market is a bustling ecosystem where various participants interact to issue, buy, sell, and manage debt securities. Understanding who these players are and what roles they perform is essential for grasping how the fixed income market functions.

Key Participants in the Fixed Income Market:

1. Issuers:

These are entities that raise capital by issuing bonds or other fixed income securities. They include:

- Governments: National, state, and municipal governments issue bonds to fund operations and projects.

- Corporations: Companies issue corporate bonds to finance business expansions, acquisitions, or working capital.

2. Investors:

These participants buy fixed income securities as part of their investment strategy. They include:

- Retail Investors: Individual investors who invest directly or via mutual funds.

- Institutional Investors: Pension funds, insurance companies, mutual funds, and banks that invest large sums.

- Foreign Investors: Overseas entities investing in Indian fixed income markets, influenced by currency and regulatory factors.

3. Intermediaries:

These entities facilitate transactions between issuers and investors, providing liquidity and market efficiency.

- Investment Banks and Underwriters: Manage the issuance and distribution of bonds.

- Brokers and Dealers: Facilitate trading in primary and secondary markets.

- Credit Rating Agencies: Evaluate credit risk and assign ratings that influence investor decisions.

4. Regulators:

Bodies like the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) oversee market operations, ensure transparency, and protect investors.

Example: When the Government of India issues bonds, the RBI acts as the issuer’s agent, managing auctions and secondary market operations. Institutional investors like mutual funds and insurance companies buy these bonds as part of their portfolios.

Why Understanding Market Participants Matters:

- Helps investors know who influences bond prices and liquidity.

- Provides insight into how bonds are issued, traded, and regulated.

- Aids in understanding the roles and motivations of different players.

India’s fixed income market has seen growing participation from foreign investors, especially in government securities, alongside large domestic institutions like LIC and EPFO. RBI’s policies and SEBI’s regulations play a crucial role in maintaining market stability and investor confidence.

The fixed income market is a dynamic system involving various players working together to facilitate capital flow. Understanding these participants is key to navigating and investing wisely in the bond market. In the next chapter, we will explore the Primary and Secondary Bond Markets, detailing where and how bonds are issued and traded.

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.