Kotak

Stockshaala

Chapter 2 | 5 min read

Structure of the Budget

Two Broad components of the government budget are:

(i) Budget Receipts

(ii) Budget Expenditure

In this chapter, we will only look at Budget Receipts

Imagine you have a big piggy bank, and each year, you expect to get money from different places—like birthday gifts, pocket money, and selling old toys. Budget Receipts are like your guess of how much money you'll get in your piggy bank from all these sources throughout the year. So, if you think you'll get ₹50 from your birthday, ₹30 from pocket money, and ₹20 from selling toys, then your total Budget Receipts for the year would be ₹100.

Similarly, Budget Receipts refer to estimated money receipts of the government from all sources during the fiscal year. Budget Receipts are classified as under:

- Revenue Receipts

- Capital Receipts

Revenue Receipts

Revenue receipts are those money receipts of the government which show two characteristics:

(i) These receipts do not create any corresponding liability for the government. Example: Tax Receipts. Tax is a revenue receipt because it does not involve any corresponding liability for the government as it is a unilateral (one-sided) compulsory payment to the government, and

(ii) These receipts do not cause any reduction in assets of the government. For example; Tax receipts do not lead to any reduction in assets of the government.

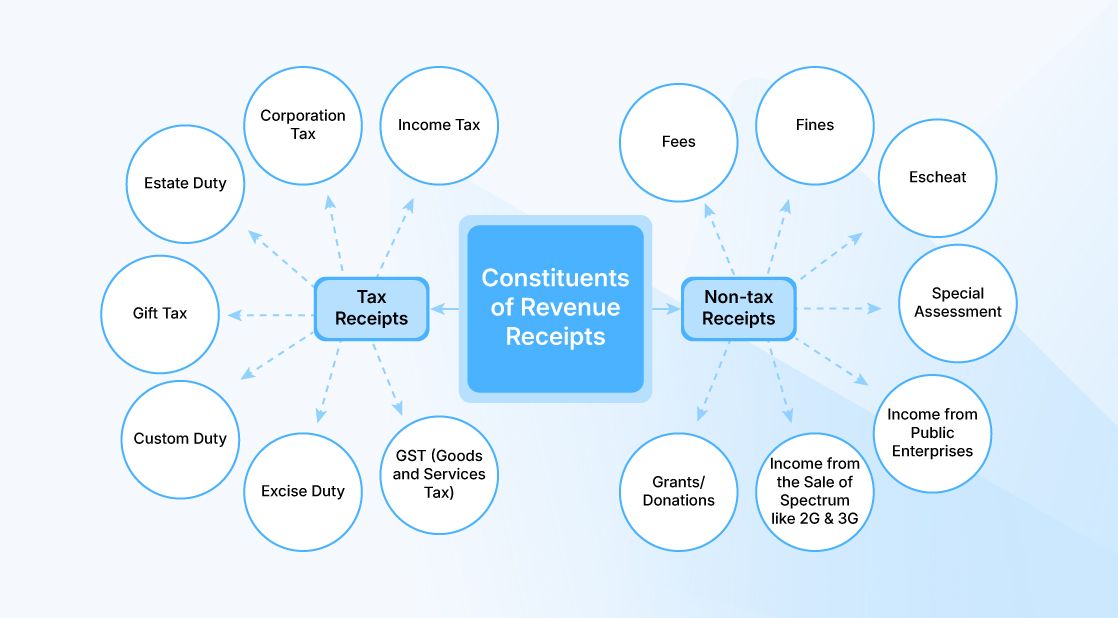

Constituents of Revenue Receipts

As you can see in the above chart, revenue receipts are classified into tax receipts and non tax receipts.

Tax Receipts: A tax is a compulsory payment to the government by households, firms or other institutional units. The taxpayer cannot expect any service or benefit from the government, in return. Let's see the types of tax Receipts:

- Progressive Tax: As the name suggests, a tax is said to be progressive when the rate of tax increases with an increase in income. So that the real burden of the tax is more on the rich and less on the poor. Example: The current tax rate is 0% for income between 0 to ₹3 lakh, 5% for income between ₹ 3 lahks to ₹ 7 lahks, 10% for income between ₹ 7 lahks to ₹ 10 lakh, 15% for ₹ 10 lahks to ₹ 12 lakhs, and so on. Thus, the tax rate increases as the level of income increases.

- Regressive Tax: A tax is said to be regression when it causes a greater real burden on the poor than the rich. If a person with ₹ 1 lakh as his monthly salary pays 10 % income tax i.e ₹ 10,000, he still has a balance of ₹90,000 per month. But if a person with ₹ 5,000 as his monthly income has to pay 10% income tax i.e 500, it might mean a cut in his essential consumption leading to poor diet and therefore, poor health. Thus, a constant rate of taxation on the rich and the poor is a regressive tax, as it causes a greater real burden on the poor than the rich.

- Value Added Tax (VAT): Value-added tax is an indirect tax which is imposed on 'Value Added' at the various stages of production. Value Added refers to the difference between the value of output and the value of intermediate consumption. It is imposed at each stage of production.

- Specific Tax: When a tax is levied on a commodity based on its units, size or weight, it is called the specific tax.

- Direct Tax: A direct tax is a type of tax that is directly imposed on an individual or organisation and is paid directly to the government. The tax burden cannot be shifted to someone else. Direct taxes are typically based on income, property, or wealth.

- Indirect Tax: It is the tax which is imposed on one person but is paid by another. The burden of indirect taxes can be shifted to others. Example: Good and Service Tax (GST).

Non-Tax Receipts: Non-tax receipts are revenues that a government earns from sources other than taxes. These are various forms of income that contribute to the government's budget but do not involve direct taxation of individuals or businesses. The following are types of non-tax receipts:

- Fees: A payment to the government for the services provided to the people. Example land registration fees, birth and death registration fees, passport fees etc.

- Fines: Fines are those payments which are made by the lawbreakers to the government. The aim is not to earn revenue, but to make people respectful to laws.

- Escheat: It refers to the income of the state which arises out of the property left by the people without a legal heir. There are no claimants of such property. The government makes revenue out of it.

- Special Assessment: A special assessment is a payment required from property owners whose property value has increased due to government development activities, such as road construction, sewage systems, or drainage improvements. This payment helps recover part of the development costs.

- Income from public enterprise: Several enterprises are owned by the government such as Indian Oil. The profit of these enterprises is a source of revenue for the government.

- Grants / Donations: It is very common for people to offer donations and grants to the government when there are natural calamities like earthquakes, floods etc.

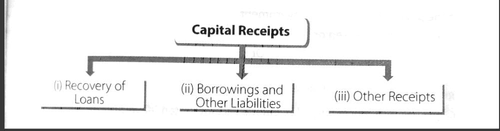

Capital Receipts

Capital Receipts are those money receipts of the government which either create a liability for the government or cause a reduction in its assets.

- Recovery of Loans: The central government offers loans to the state government to cope with the financial crises. When these loans are recovered, the assets of the government are reduced.

- Borrowing & other Liabilities: The government borrows money from: The general public. the RBI, the rest of the world (taking loans from foreign governments, international organizations, or through issuing sovereign bonds to international investors).

- Other Receipts: This includes disinvestment, where the government sells its shares in public sector enterprises to the private sector, leading to privatization. The money received is considered a capital receipt, as it reduces the government's assets.

In conclusion, Budget Receipts are key to how the government funds its activities. Revenue Receipts give steady income without creating new debts or reducing assets, while Capital Receipts involve borrowing money or selling assets. Understanding these receipts helps us see how well the government is managing its finances and supporting growth.

Recommended Courses for you

Beyond Stockshaala

Discover our extensive knowledge center

Learn, Invest, and Grow with Kotak Videos

Explore our comprehensive video library that blends expert market insights with Kotak's innovative financial solutions to support your goals.