UPI Turned India Into a Payments Superpower

- 7 min read

- 5,618

- Published 26 Dec 2025

106.36 billion transactions.

That's what India processed in just six months of 2025.

Not through banks. Not through cards.

Through phone taps and QR codes.

UPI didn't announce itself. It crept in. One chai payment at a time.

Now it owns half the world's real-time payments.

And fintech companies are building empires on top of it.

The question isn't whether UPI changed payments anymore.

It's whether you're tracking what's being built on top of it.

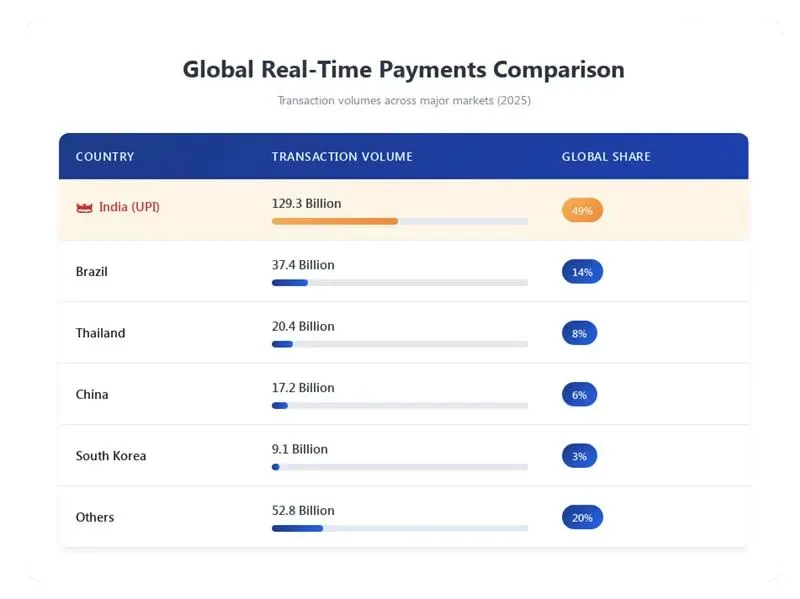

Because UPI now accounts for nearly 49% of all real-time payment transactions globally.

India didn't just join the digital payments race. It lapped everyone else.

The Numbers That Rewrote the Playbook

₹143 lakh crore moved through UPI between January and June 2025.

A 35% jump from the year before.

Not from big corporate deals. From millions of tiny ones.

Metro tickets. Electricity bills. Street food. Mobile recharges.

The average transaction? Down from ₹1,478 to ₹1,348.

That drop tells the real story.

UPI isn't just about convenience anymore. It's the default.

The shift from convenience to necessity is what investors miss.

When payment size shrinks but volume explodes, you're watching behaviour change at scale.

India now handles 49% of all real-time payments globally.

Brazil comes second at 14%. Thailand at 8%. China at 6%.

The gap isn't close. It's a canyon.

In the time it takes Brazil to process a year's worth of transactions, India does it in six months.

That velocity matters. Because it means Indian fintechs are iterating on live, high-frequency data that few global peers can access.

When QR Codes Conquered India

67.8 crore QR codes.

That's how many India deployed by mid-2025. Double the count from 18 months ago.

They're not just in cities anymore.

The spread is deliberate. Government-backed programmes like the Payments Infrastructure Development Fund are pushing QR deployment deep into smaller towns.

Tier-III to Tier-VI towns alone have over 5.45 crore payment touchpoints.

The kirana store in rural Maharashtra accepts UPI.

The roadside vendor in Patna accepts UPI.

The vegetable seller in Ranchi accepts UPI.

Cash hasn't disappeared. But it's becoming the backup option.

And that shift is where merchant-focused fintech plays are finding their edge.

How Fintech Learned to Love UPI

UPI changed the game quietly.

Payment gateways used to fight cart abandonment with discounts and pop-ups.

UPI fixed that. One tap. Done. Cart abandonment dropped.

Conversion rates climbed, especially on mobile.

Neobanks used to guess creditworthiness from salary slips and bank statements.

UPI handed them transaction trails. Real spending behaviour. Real repayment patterns.

Lending platforms used to demand collateral and credit scores.

UPI showed them payment consistency. Risk became calculable without traditional paperwork.

The format itself evolved too.

PIN-less flows arrived. Biometric authentication followed. Payments became almost invisible.

UPI AutoPay now handles recurring bills—electricity, subscriptions, EMIs.

Credit-on-UPI bridges short-term cash gaps right at checkout.

Seamless e-commerce integration keeps transactions fast and friction-free.

Layer by layer, UPI stopped being just a payment rail.

It became a daily financial operating system.

And the fintech companies that figured this out early are now sitting on compounding advantages.

The Credit Play Nobody Saw Coming

Here's where it gets interesting.

UPI transaction history is becoming the new credit score.

Your chai payments. Your grocery spends. Your rent transfers. Your Swiggy orders.

Lenders are reading all of it.

They're sizing up risk in real-time without touching a single salary slip.

Small business owners without formal bank statements? Covered.

Gig workers without payslips? Not a problem.

UPI gives lenders a live feed of cash flow behaviour.

Buy-now-pay-later platforms use it. Micro-loan startups use it. Embedded lending products use it.

The broader shift is profound. Credit underwriting is moving from static documents to dynamic transaction patterns.

Fintech firms can price risk more accurately, design personalised offers, and expand lending into segments traditional banks wouldn't touch.

In the process, UPI is quietly becoming the data spine of India's digital credit economy.

And that's where the real monetisation is happening—not in transaction fees, but in the financial products layered on top.

Where the Smart Money Is Moving

For investors tracking fintech, UPI is no longer just a payments story.

It's an ecosystem signal.

Merchant acquiring platforms are the quiet winners here.

They're monetising volume, not transactions.

Adding reconciliation tools. Real-time analytics. Lending hooks. Subscription management.

The more services they stack, the stickier they become.

Payment gateways and checkout SaaS companies are having their moment too.

Faster checkouts. Higher conversions. Lower drop-offs.

Every basis point improvement in conversion rates translates to material revenue gains for e-commerce platforms. Neobanks and digital lending platforms sit close to the action.

With access to rich UPI transaction trails, they can underwrite credit with precision and scale lending without relying on collateral-heavy traditional models.

Then there are the infrastructure plays—QR code manufacturers, POS providers, payment hardware suppliers.

They're the picks-and-shovels of this digital gold rush.

Spreading payments infrastructure to the last mile, one kirana store at a time.

The pressure points are just as visible.

Traditional banks and card networks are bleeding volume.

Debit card usage is shrinking. Credit card relevance is being questioned.

Legacy payment processors face a stark choice: evolve quickly or get sidelined by leaner, software-first players building directly on UPI rails.

In this market, scale alone won't save you. Adaptability will.

The Cracks in the System

UPI may be everywhere, but it is not invincible.

Infrastructure gaps still show up in low-connectivity regions.

Patchy networks slow adoption and remind us that digital rails need constant physical support.

As volumes rise, so do concerns around data security and fraud.

Regulators and ecosystem players are walking a fine line—keeping payments seamless while keeping them safe.

Then there's competition.

Global payment networks are watching India closely.

Newer decentralised finance models are testing alternative ways to move money.

WhatsApp Pay, Google Pay, PhonePe—they're all jockeying for position.

Market share battles are intensifying.

And international players haven't given up on cracking India.

UPI's next phase depends on how quickly the system adapts, upgrades, and stays flexible.

Dominance today doesn't guarantee relevance tomorrow.

The ecosystem knows it. And the smart money is watching who adapts fastest.

The Bottom Line: UPI Is Today’s Fintech Economy

India isn't just using UPI.

It is building an entire economy on top of it.

From kirana payments to digital credit.

From merchant acceptance to financial inclusion.

The global financial system is watching. Many are trying to replicate it.

Few will succeed at India's scale.

Because UPI didn't just change payments. It rewired how 1.4 billion people handle money.

And fintech companies are riding that wave straight to the market rally.

The investment thesis is simple: follow where UPI flows.

Merchant platforms. Lending tech. Payment infrastructure. Embedded finance.

These aren't side bets. They're the core plays in India's fintech future.

UPI started as a tap-and-pay convenience.

Now it's the engine driving India's fintech market rally.

And the rally is just getting started.

Sources:

- Economic Times BFSI

- Press Information Bureau

- Livemint

- Ministry of Electronics & Information Technology

0 people liked this article.