The Oil Shock That Didn’t Shake India

- 5 min read

- 1,026

- Published 09 Jan 2026

There is a strange consistency to global power politics.

Every few decades, the map lights up around the same spots.

More often than not, those spots sit on oceans of crude.

Iraq in the early 2000s, Libya a decade later.

Iran under constant pressure, and now Venezuela back in the headlines.

The United States has historically played an outsized role in regions rich in oil reserves.

Sometimes with sanctions, sometimes with diplomacy, and sometimes with operations.

Venezuela, sitting atop nearly 303 billion barrels of proven oil reserves, was never going to be left alone forever.

So when reports emerged of Operation Absolute Resolve and the US attempt to corner Nicolás Maduro, the instinctive reaction in Indian markets should have been panic.

Oil shock headlines usually do that.

Crude spikes, the rupee flinches, energy stocks swing wildly, and inflation fears crawl back into trading screens.

Except this time, nothing quite behaved the way history textbooks would suggest.

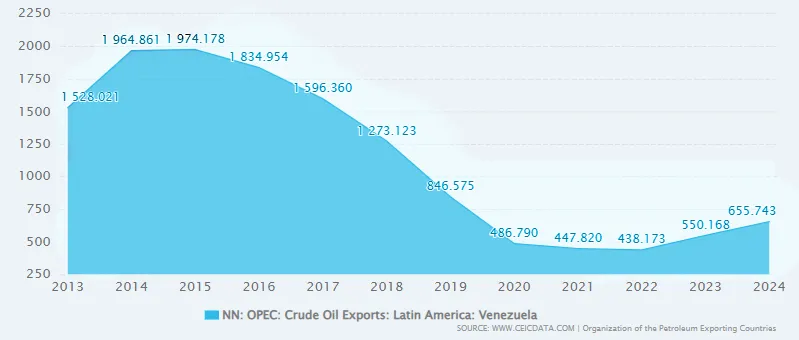

Venezuela’s Collapse, Told in Barrels and Bad Decisions

Venezuela’s oil story is tragic in slow motion.

Once upon a time, oil was not just an export; it was the economy.

Nearly 95% of export earnings and government revenues flowed from petroleum.

In the late 1990s, the country pumped over 3.5 million barrels per day, placing it firmly among the world’s energy heavyweights.

By 2025, production had fallen to roughly 1.1 million barrels per day, despite holding the largest oil reserves on the planet.

That collapse did not happen overnight.

Nationalisation under Hugo Chávez pushed out foreign operators.

PDVSA, the state oil company, became bloated with political appointees while experienced engineers quietly exited.

Investment slowed, maintenance was skipped, and infrastructure aged badly. Refineries ran below capacity, wells declined, and oil became both the only pillar and the weakest link. Sanctions tightened the knot.

Between 2017 and 2019, the US and others targeted Venezuela’s oil sector directly.

The damage compounded year after year.

Analysts estimate oil revenue losses between 2017 and 2024 amounted to about $226 billion, equivalent to 213% of GDP.

That is roughly $77 million evaporating every single day.

The macro fallout was brutal.

GDP growth limped along at a forecast 0.5% in 2025.

Inflation reversed course and surged to 549%.

The Venezuelan Bolívar lost nearly 80% of its value in one year alone.

Since 2014, around 8 million people, roughly a quarter of the population, have left the country.

Oil did not just fail Venezuela. It trapped it.

Venezuela's Crude Oil Exports from 2013 to 2024

Source: CEIC

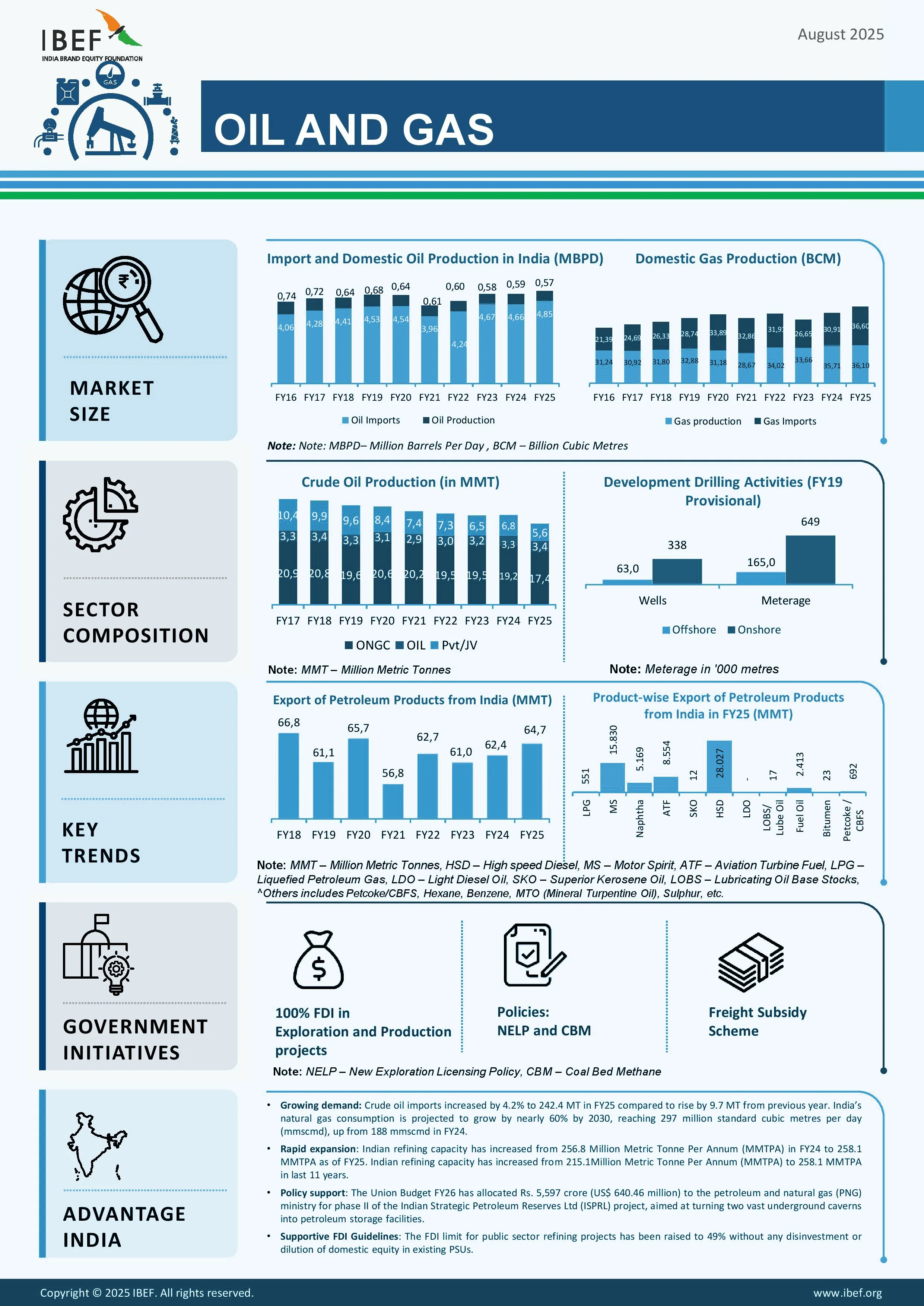

Why India Did Not Flinch

And yet, while Venezuela unravelled again, India barely blinked.

This is where the story becomes interesting for markets.

India imports oil heavily.

In FY 2023 to 2024, crude imports touched about 234.26 million tonnes, nearly 88% of demand.

Domestic production contributes under 13%.

On paper, that looks dangerously exposed.

But India’s energy story is no longer a one-note song.

Coal still anchors the system, accounting for around 48% of total primary energy supply and dominating electricity generation.

India is also one of the world’s largest coal producers and consumers, a reality that provides stability even when crude markets misbehave.

Then comes diversification.

Renewables have moved from ambition to scale.

Installed power capacity jumped from 375 GW in 2020 to 510 GW by December 2025, with renewables driving most of the new additions.

The target of 500 GW of non-fossil capacity by 2030 is not just a press release anymore.

It is being built panel by panel and turbine by turbine.

Natural gas adds another layer.

Its share, currently around 8%, is expected to rise to 15% by 2030 as LNG infrastructure expands and import sources diversify.

For investors, this matters.

Energy shocks hurt countries that have no alternatives.

India now has several.

Another reason India stayed calm lies in the changing role of the United States in Venezuela’s oil story.

If US involvement eventually helps stabilise Venezuelan production, any return of supply is more likely to happen gradually than through sudden shocks.

That kind of reintegration adds barrels to the global market over time, instead of choking it.

For India, this matters.

The country now relies on a wide mix of crude sources and is less exposed to disruptions caused by any one supplier.

If Venezuelan oil comes back under a more predictable framework, it would likely ease price pressures rather than worsen them.

In short, the headlines may look tense, but the supply math has changed.

And this time, the markets seem to be reacting to the math, not the noise.

Source: India Brand Equity Foundation (IBEF)

The Quiet Power of Strategic Buffers

There is also something deeply unglamorous but immensely powerful sitting underground - Strategic Petroleum Reserves.

India’s SPRs at Visakhapatnam, Mangaluru, and Padur hold about 5.33 million metric tonnes, roughly 39 million barrels.

That covers about 9.5 days of domestic consumption.

Combine that with commercial refinery stocks, and the buffer stretches to 74 days.

Plans are already in motion to push that towards 90 days.

This is not about trading gains.

It is about psychological stability.

When markets know a country has time on its side, knee-jerk reactions soften.

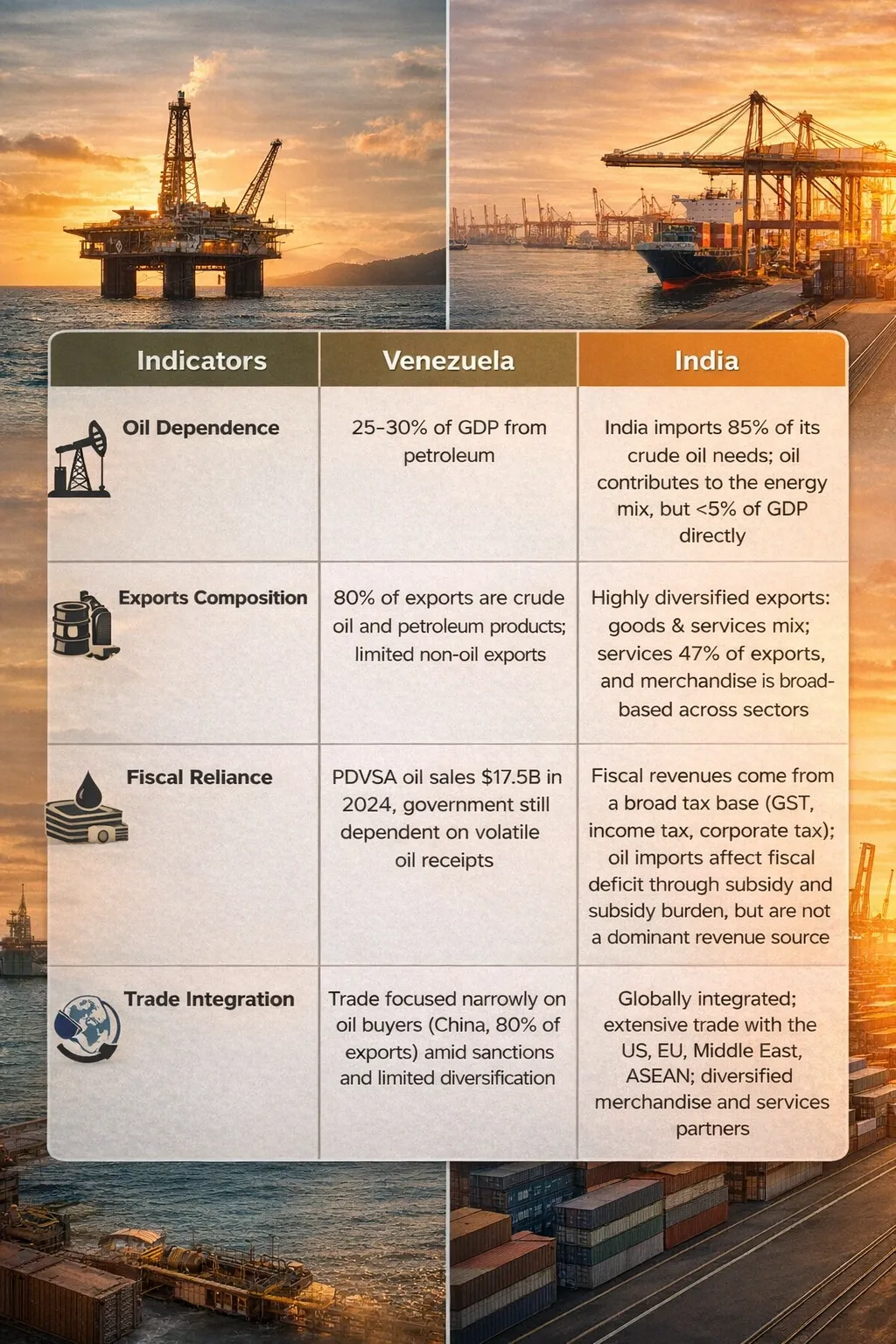

Two Economies, Two Outcomes

The contrast becomes clearer when you place the two economies side by side:

Policy as the Invisible Shock Absorber

India’s policy framework quietly absorbs oil tremors.

Petrol was deregulated in 2010, diesel in 2014, slashing fiscal under-recoveries that once touched ₹1.4 lakh crore.

Natural gas pricing was reworked in 2023, linking it to 10% of the Indian crude basket, reducing volatility for consumers and encouraging domestic production.

Fossil fuel subsidies were cut by about 85% between 2013 and 2023, falling from roughly $25 billion to $3.5 billion. That capital did not disappear.

It shifted towards renewables and infrastructure.

India has started long-term projects like the Integrated Energy Policy and the National Green Hydrogen Mission.

These aim to make 5 million tonnes of green hydrogen by 2030, with $2.4 billion in support.

Public sector giants anchor the transition.

ONGC plans nearly ₹2 lakh crore of investment into new energy and decarbonisation by 2038.

IOC and BPCL are expanding infrastructure and cleaner fuels.

For market participants, this shift changes how geopolitical risk should be read.

Not every oil headline now deserves a portfolio reaction.

In a market with buffers, diversification, and policy flexibility, resilience itself becomes a variable worth tracking.

What Traders Should Really Be Watching

Venezuela may dominate headlines, but India’s response tells the real market story.

Oil shocks still matter, but they no longer dictate outcomes.

Crude prices wobble, energy stocks digest, and the rupee stays remarkably composed.

The opportunity lies in understanding that resilience has value.

PSU energy stocks, renewable players, gas infrastructure, and even inflation-sensitive sectors are no longer hostage to every geopolitical flashpoint.

The panic trade is slowly losing its edge.

Oil may still move markets.

But for India, the age of energy-induced panic appears to be fading.

And that, quietly, changes everything.

Sources and References:

- ABCNEWS

- NYTIMES

- THETRICONTINENTAL

- REUTERS

- ECONOMICSOBSERVATORY

- IMF

- CEICDATA

- DRISHTIIAS

- NEXTIAS

- TIMESOFINDIA

- IBEF

- WIKIPEDIA

- SPGLOBAL

- LIVEMINT

- BUSINESSTODAY

- GROKIPEDIA

- OUTLOOKBUSINESS

- FIPI

- THEHINDU

0 people liked this article.