Investors Are Looking Back at a Sector the World Wants to Move On From

- 5 min read

- 5,334

- Published 14 Jan 2026

For most of the last century, power did not shout.

It did not need to.

It showed up quietly.

On maps shaded in odd colours.

Along borders drawn a little too carefully.

Always circling what lay underground.

There was a time when Oil fields shaped friendships, Mineral belts decided alliances. Coal seams built economies long before balance sheets ever did.

From the Middle East to Latin America, global attention has followed this pattern with remarkable consistency.

Countries rich in something extractable rarely stayed invisible for long.

Venezuela’s oil is only the latest chapter in a much older book.

Before that came Copper in Chile, Bauxite in Guinea, and even Iron ore quietly pulling capital, policy, and pressure in their direction.

Markets, of course, prefer to forget this history.

They like to believe they are driven by innovation cycles, earnings stories, and shiny new narratives and not by what sits beneath the surface.

But capital has always had a longer memory than markets admit.

Which is why the current rediscovery of mining feels less like a comeback and more like a correction.

Mining, in that sense, never disappeared.

It simply spent a few decades out of fashion.

When Mining Was the Economy

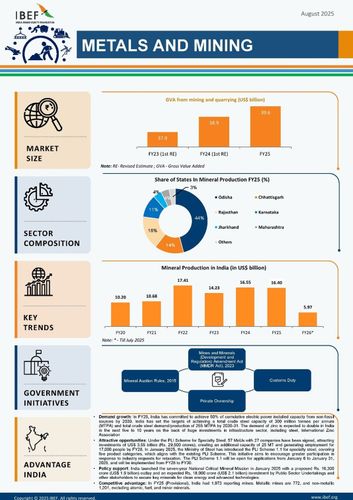

India’s own relationship with mining mirrors this cyclical amnesia.

Before the 1990s, the sector lived behind licences and paperwork, tightly regulated and largely closed to foreign capital.

Reforms in the 1990s and early 2000s cracked the door open, allowing private players and overseas investors to step in and slowly change the scale and structure of the industry.

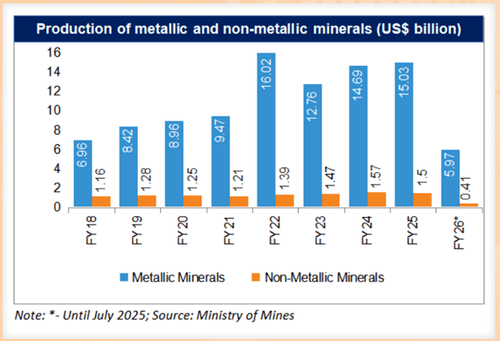

By 2024 to 2025, India was producing 95 minerals.

Metals dominated value creation, with iron ore alone accounting for nearly 70% of total mineral value.

Output touched 289 million metric tonnes, growing about 4% to 5% year on year.

Manganese and Bauxite followed suit, clocking 6% to 12% growth in the first half of FY25.

Globally, India now ranks fourth among iron ore producers and third among limestone producers.

In states like Chhattisgarh, mining has become more than an industrial line item.

Its share of GSDP climbed to 10% in FY25, while mineral revenues exploded more than 34 times over 25 years to ₹14,600 crore.

This is not a sunset industry behaviour.

Source: India Brand Equity Foundation (IBEF)

Commodities Remember How to Run

What has really pulled mining back into conversations is price memory returning to the market.

FY25 reminded investors that commodities do not stay dormant forever.

Copper has been the loudest messenger.

International prices surged to nearly $12,600 to $13,000 per metric tonne by early 2026, up roughly 45 to 50% through 2025 as supply stayed tight and industrial demand refused to cool.

India echoed that move almost perfectly.

MCX Copper jumped from around ₹796 per kg to about ₹1,197 per kg in 2025, another clean 50% move.

The reason is structural, not speculative.

Copper deficits are projected to persist into 2026 as electric vehicles, renewable grids, and AI data centres chew through supply faster than new mines can come online.

BloombergNEF has already flagged potential shortages beginning as early as 2026 if fresh capacity does not arrive.

Precious metals followed a different script but reached the same destination. Gold held firm at record levels as macro uncertainty refused to fade.

Even, Zinc and aluminium logged steadier gains, while oil remained volatile, never quite exiting the room.

This is what a commodity cycle waking up looks like.

Source: India Brand Equity Foundation (IBEF)

Dalal Street Rediscovers Coal

Against this global backdrop, India’s mining revival found a headline moment in an unlikely place - Bharat Coking Coal Limited.

The BCCL IPO opened on 9 January 2026 and promptly attracted 16.8 times subscription.

Ahead of the issue, ₹273 crore came in from anchor investors, including LIC and Société Générale, a signal that institutional money was not treating this as a nostalgia trade.

Structured entirely as an offer for sale by Coal India, the IPO mobilised roughly ₹1,070 to ₹1,300 crore without injecting fresh capital into BCCL.

This was not about funding expansion.

It was about investor appetite. And that appetite was real.

For markets, the significance runs deeper than one listing.

This was less a vote on coal’s future dominance and more a signal that cash-generating, operationally relevant sectors are being looked at again.

Why Capital Is Circling Back

Mining’s return is not sentimental.

It is mathematical.

Demand for strategic metals tied to renewables, EVs, infrastructure, and AI gives diversified miners long-term visibility.

Gold miners gain from persistent uncertainty.

Domestic plays like BCCL offer exposure to industrial essentials backed by regulatory support.

At the same time, risks remain firmly on the table.

Commodity prices swing, and early 2026 has already seen weekly pullbacks in base metals after strong 2025 gains.

Environmental and regulatory pressures continue to hang over coal and thermal power. Cyclicality remains non-negotiable.

Mining profits still rise and fall with global growth and capital expenditure cycles.

But this is precisely why investors are looking again.

Mining is no longer being treated as a growth fantasy.

It is being priced as a cash flow business.

Investors are not rewriting the energy transition.

They are simply pricing what still powers the economy today.

The Quiet Investor Shift

The bigger story is behavioural.

Investors are rediscovering sectors that preserve capital, throw off dividends, and sit closest to physical demand.

In a world where AI needs Copper, grids need coal backup, and renewables still depend on mined materials, the idea of leaving mining behind has started to look naive.

Mining did not change. Markets did.

And in rediscovering old industries, investors may be revealing something new about how capital is learning to behave.

Sources and References:

- HINDICURRENTAFFAIRS

- NATIONALMINERALSCENARIO

- PIB

- TIMESOFINDIA

- IBEF

- ECONOMICTIMES

- BUSINESSTODAY

- MINING

- CHRONICLEJOURNAL

- BUSINESSSTANDARD

0 people liked this article.